30+ Self employed health insurance

The cost of public liability insurance for self-employed and sole traders depends on many factors including the type of industry you work in. If you have an S-corp you should be aware of a 2015 notice regarding reimbursement.

What Is The Employer Shared Responsibility Provision Healthinsurance Org

A difference-in-difference study of childhood immunization coverage from 180 countries.

. Self-employed people are both the employer and the employee. Youre considered self-employed if you have a business that takes in income but doesnt have any employees. Self-employed individuals need an alternative to employer-sponsored health insurance.

30 min spend delivery fees radius vary by outlet. 2020 and ending on June 30 2020. Get 30 Discount No Sublimit on Room Rent Emergency Hospitalization Abroad Cover 30 Discount on Premium.

You have to be able to document your earnings however. Self-employed individuals who meet certain criteria may be able to deduct their health insurance premiums even if their expenses do not exceed the 75 threshold. If youre self-employed you can use the individual Health Insurance Marketplace to enroll in flexible high-quality health coverage that works well for people who run their own businesses.

Therefore they pay both halves of the Social Security and Medicare contributions called self-employed tax or SE tax which totals. After 11302022 TurboTax Live Full Service customers will be able to amend their 2021 tax return themselves using the Easy. The deduction that allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.

Dont include personal or financial information like your National Insurance. Standard premium for 30 year old Healthy male 1Cr life cover 25 years policy term 25 years premium payment term exclusive of GST for Max Life. Health insurance premiums for the self employed are deducted to determine MAGI Line 29 of Form 1040.

Check how to calculate income tax for self-employed how to file self-employed ITR form. Self-employment is the state of working for oneself rather than an employer. You can buy an insurance plan any time of year even if its outside Open Enrollment.

Updated to reflect the extension of self-isolation to 10 days. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed. Jul 30 2022 706am.

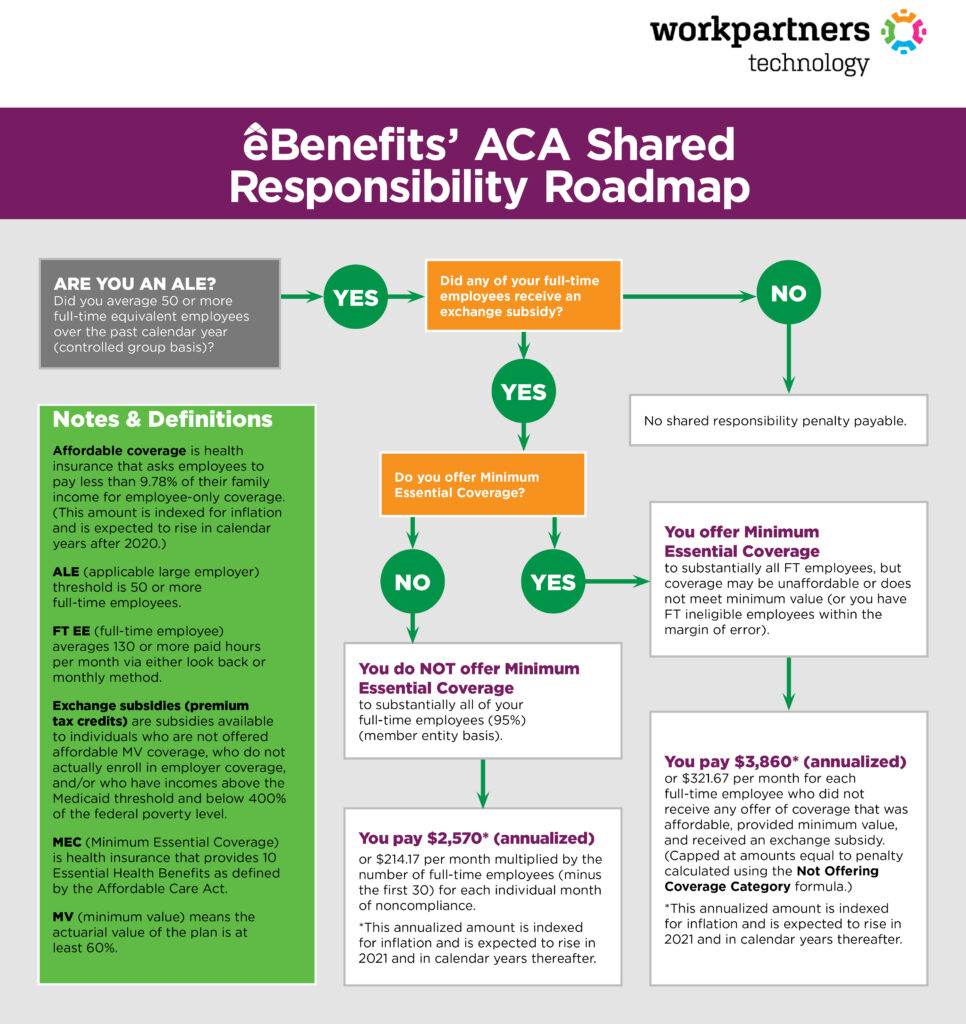

Under these provisions certain employers called applicable large employers or ALEs must either offer health coverage that is affordable and that provides minimum value to their full-time employees and offer coverage to the full. 30 July 2020. I could see where there are two solutions that work mathematically.

If youre a freelancer an entrepreneur a part-time worker or self-employed you have a few coverage options that work well for independent careers and lifestyles. In the following years to keep getting SNAP you will need to provide them with your 1040 tax forms to prove you are indeed self-employed. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost.

Schedule F Profit or Loss from. Health Insurance Over 50s Life Insurance Income Protection. ITR for self-employed is covered under ITR form 4 which includes profession businesses.

You can do the self-employment ledger your first year on SNAP. Affiliate marketing may overlap with other Internet marketing methods including organic search engine optimization SEO paid search engine marketing PPC Pay Per Click e-mail. Affiliate marketing is a type of performance-based marketing in which a business rewards one or more affiliates for each visitor or customer brought by the affiliates own marketing efforts.

3L Plan Starts At 291month. TurboTax Self-Employed Online tax software is the perfect tax solution for independent contractors freelancers and business owners for preparing your income taxes. Form 8941 Credit for Small Employer Health Insurance Premiums.

Solution 1 No subsidy MAGI is 12000 60 below 100 FPL. 50 off Pizzas 7 days a week. Health insurance Accident cover Whole of life insurance Funeral insurance.

The employer shared responsibility provisions were added under section 4980H of the Internal Revenue Code by the Affordable Care Act. Iv the term eligible recipient means an individual or entity that is. If you leave a job for any reason and lose job-based insurance.

For the self-employed health insurance premiums became 100 deductible in 2003. In the real world the critical issue for the tax authorities is not whether a person is engaged in a business activity. Excluding boiler cover and travel services excluding travel insurance and car hire excess insurance.

If you are self-employed it is still possible to get a mortgage as this guide explains. The Marketplace offers high-quality and flexible health coverage. 11 An entity that is designated as a safe workplace association or as a medical clinic or training centre specializing in occupational health and safety matters under section 6 of the Workplace Safety and Insurance Act 1997 on the date section 20 of the Occupational Health and Safety Statute Law Amendment Act 2011 comes into force is deemed.

Read on to. With so many providers policies rules and payment options to consider finding the best health insurance as a self-employed person can be tricky. DIVISION A--KEEPING WORKERS PAID AND EMPLOYED HEALTH CARE SYSTEM ENHANCEMENTS AND ECONOMIC STABILIZATION TITLE I--KEEPING AMERICAN WORKERS PAID AND EMPLOYED ACT Sec.

This process can also be used to get Medicaid health insurance. 232 Tax Deductions Vs. You are self-employed an independent contractor a 1099 filer a farmer and youre experiencing a significant reduction of services because of the COVID-19 public health emergency You provide services to an educational institution or educational service agency and are unemployed or partially unemployed because of volatility in the work.

After 11302022 TurboTax Live Full Service customers will be able to amend. If you qualify the deduction for self-employed health insurance premiums is a valuable tax break. Self-employed individuals such as freelancers consultants independent contractors or other self-employed workers who dont have any employees have the opportunity to enroll in the Individual Health Insurance Marketplace.

For example if your regular rate were 30 per hour and you lawfully took 20 hours of paid sick leave to self-quarantine based on the advice of a health care provider you may recover 600 30 per hour times 20 hours from your employer. M3 Elevate experts can step in and help with. Business and self-employed.

Universal healthcare coverage and health service delivery before and during the COVID-19 pandemic. Assume income before Line 29 deduction is 24000 and unsubsidized premiums are 1000month. We reviewed availability reputation and more to find the best options.

Employer Shared Responsibility Fee Ebenefits

Does Every Business With 50 Or More Employees Pay A Penalty If It Doesn T Offer Affordable Comprehensive Insurance Healthinsurance Org

2

Small Business Health Options Program Health For California

How Obamacare Changed Group Health Insurance Healthinsurance Org

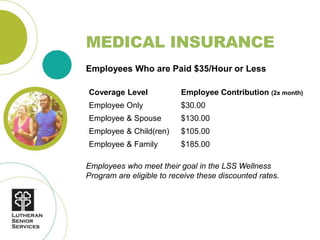

Benefits At A Glance

2

Friday Health Plans Careers And Employment Indeed Com

2

2

Patient Discounts Valley Health

Does Every Business With 50 Or More Employees Pay A Penalty If It Doesn T Offer Affordable Comprehensive Insurance Healthinsurance Org

Health Insurance Downtown Orlando Bertwill Health

Individual Health Insurance Gta Insurance Group

Employer Insurance 101 The Basics Ppt Download

2

Questions To Ask When Choosing Your Company S Health Insurance